Investment Strategies for Beginners – Get Complete Information

Investing is a crucial part of building wealth and securing your financial future. However, for beginners, the world of investments can be overwhelming and complex. Additionally, it’s important to start with a solid foundation and adopt strategies that align with your risk tolerance and financial goals. “Empower your fiscal future with smart investing opinions edited to your market aims. Explore a different range of investments to secure your fiscal future through strategic fiscal investment choices. Likewise, in this companion, we’ll figure some effective investment strategies edited for newcomers.

https://fortune.com/recommends/investing/how-to-start-investing/

1. Set Clear Financial Goals For Investment

Before you start investing, it’s essential to define your financial objectives. Are you saving for retirement, a down payment on a house, or an emergency fund? Additionally, Knowing your goals will help you determine your investment horizon and risk tolerance.

2. Diversification is Key For Investment

Diversifying your investments means spreading your money across different asset classes like stocks, bonds, real estate, and goods. Furthermore, this helps to reduce the overall threat in your portfolio. Additionally, a diversified approach can give a more stable and balanced return on investment.

3. Start with an Emergency Fund For Investment

Before making any significant investments, insure you have an emergency fund in place. Moreover, this fund should cover three to six months’ worth of living charges. Additionally, it acts as a safety net, guarding your investments from unanticipated charges or job loss.

4. Educate Yourself For Investment

Knowledge is power in the world of investing. Additionally, take the time to learn about different investment options, market trends, and introductory fiscal concepts. Moreover, there are numerous resources available, including books, online courses, and financial advisors.

5. Consider Low-Cost Index Funds and ETFs For Investment

For beginners, low-cost index funds and exchange-traded funds (ETFs) are excellent options. Additionally, These funds track the performance of a specific market index, like the S&P 500. Moreover, They offer diversification and usually have lower fees compared to actively managed funds.

6. Invest for the Long Term For Investment

Patience is a virtue in investing. Avoid trying to time the market or make quick gains. Additionally, Instead, focus on a long-term strategy. Historically, the stock market has provided higher returns over extended periods.

7. Regularly Contribute to Your Investments For Investment

Harmonious benefactions, indeed if they’re small, can have a significant impact over time due to the power of compounding. Moreover, set up automatic benefactions to your investment accounts to insure you re constantly adding to your portfolio.

8. Monitor and Rebalance Your Portfolio For Investment

As your fiscal situation and aims change, its important to review your investments. Additionally, rebalance your portfolio periodically to ensure it aligns with your current objectives. For example, if stocks have outperformed bonds, you may need to adjust the allocation.

9. Stay Emotionally Detached For Investment

Feelings can lead to impulsive opinions, which can be mischievous to your investments. Additionally, avoid making opinions grounded on fear or rapacity. Stick to your predetermined investment plan.

10. Seek Professional Advice When Needed

If you’re unsure about where to start or how to navigate the investment landscape, consider seeking advice from a financial advisor. Moreover, they can give substantiated guidance grounded on your specific fiscal situation and aims.

11. Understand Risk Tolerance

Knowing your risk tolerance is crucial for making informed investment decisions according to market goals. Assess how comfortable you are with the possibility of market fluctuations and potential losses. Additionally, This will help you select investments that align with your risk tolerance.

12. Stay Informed about Market Trends

Keep yourself updated on the latest market trends and economic developments according to market goals. Additionally, This knowledge can help you make informed decisions about when to buy, sell, or hold onto your investments.

13. Avoid Timing the Market

Trying to predict market movements and making decisions based on short-term fluctuations can be risky. Instead, focus on a long-term investment strategy that’s based on your financial goals and risk tolerance.

14. Consider Tax-Efficient Investing

Understanding the duty pleas of your investments is pivotal for maximizing your returns according to market aims. Moreover, consider duty-effective strategies like exercising duty- advantaged accounts (e. G., 401(k) s, Iras) and duty-effective finances to minimize your duty liability.

15. Don’t Put All Your Eggs in One Basket

Avoid overconcentration in a single investment or asset class according to market goals. Moreover, spreading your investments across colorful sectors and diligence can help reduce the impact of a downturn in any one area.

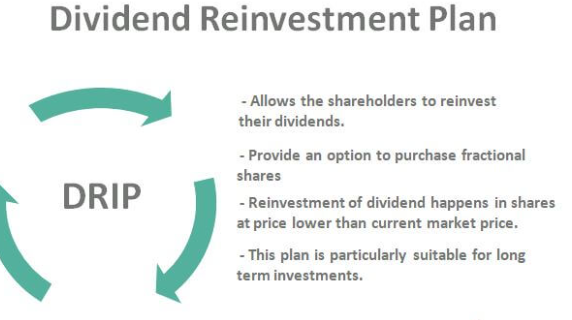

16. Reinvest Dividends and Gains

Rather than pocketing dividends and gains, consider reinvesting them back into your portfolio. Additionally, This allows you to take advantage of compounding and potentially accelerate the growth of your investments.

17. Stay Disciplined During Market Volatility

Moreover, market volatility is ineluctable, but it’s important not to let fear or fear direct your conduct. Stick to your long- term strategy and avoid making impulsive opinions during turbulent times.

18. Review and Adjust Your Portfolio Regularly

Moreover, as you progress in your investment trip, periodically review your portfolio to insure it still aligns with your aims. Life circumstances and market conditions change, and your investments should reflect these shifts.

19. Consider Alternative Investments

While stocks and bonds are the most common investments, consider exploring alternative options like real estate, peer-to-peer lending, or commodities. Moreover, these can give fresh diversification and potentially advanced returns.

20. Learn from Mistakes

Not every investment will be a winner, and that’s okay. Learn from your mistakes and use them as opportunities for growth and improvement. Moreover, reflect on what went wrong and condition your strategy consequently.

Final Thoughts

Remember, investing is a journey, not a sprint. Investing decisions requires patience, discipline, and a willingness to learn and adapt. By following these strategies and staying committed to your financial goals, you can set yourself up for long-term success in the world of investing. Always remember that seeking professional advice and investing decisions when needed is a sign of wisdom. Additionally, Investing decisions can provide valuable insights into making the best decisions for your financial future.

Conclusion

Embarking on your investment journey as a beginner can be both exciting and challenging. By setting clear goals, diversifying your investments, and staying educated, you can build a strong foundation for your financial future. Remember, consistency and discipline are key in the world of investing. Start small, be patient, and watch your investments grow over time.